As the real estate market transitions into the colder months, Dallas County is experiencing some noteworthy shifts that reflect both seasonal patterns and economic conditions. Inventory levels are rising, interest rates have ticked up, and sales are slowing—changes that are expected as we move into fall and winter. Here’s a detailed breakdown of the latest October data, along with insights into what might lie ahead.

Home Sales: Seasonal Decline as Expected 🏠

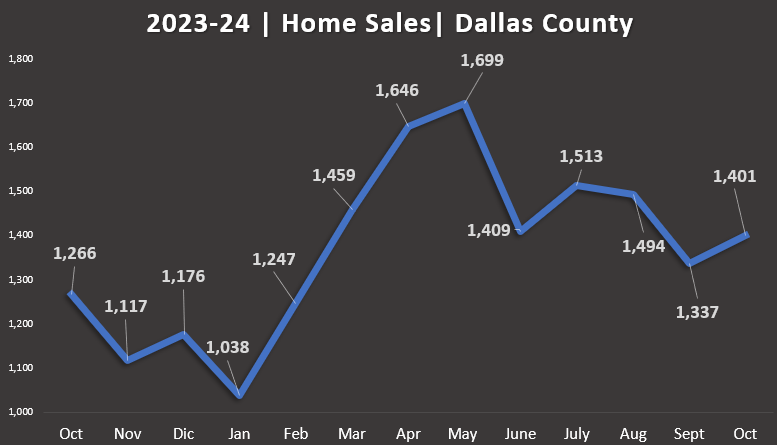

October 2024 recorded 1,401 homes sold in Dallas County, showing a slight increase from September’s 1,337 and surpassing October 2023’s 1,266. This year-over-year rise indicates steady demand, even as we enter the slower fall season. However, as we approach winter, sales are expected to continue their seasonal decline.

Recent Monthly Sales Comparison:

- July 2024: 1,513 homes sold

- August 2024: 1,494 homes sold

- September 2024: 1,337 homes sold

- October 2024: 1,401 homes sold

- October 2023: 1,266 homes sold

Historically, January tends to have the lowest sales of the year. In January 2024, only 1,038 homes were sold, reflecting the usual winter slowdown. Based on this pattern, we can anticipate a further decrease in sales for November and December, with January 2025 likely seeing similarly low activity before demand begins to pick up in February as the spring season approaches.

This trend aligns with historical patterns where buyer activity doesn’t significantly rebound until February, when warmer weather and the start of the spring season encourage more people to enter the market.

Housing Inventory: Approaching Pre-Pandemic Levels 🏘️

Inventory levels in Dallas County have been steadily rising, reaching 5,503 homes for sale in October 2024. This is a modest increase from 5,336 in September 2024 and represents a significant rise from October 2023’s 3,893 homes. This build-up in inventory marks a trend towards a more balanced market, where buyers have more negotiating power and competition among sellers intensifies.

Historical Inventory Comparison:

- October 2023: 3,893 homes available

- October 2022: 3,221 homes available

- October 2019 (pre-pandemic): 5,954 homes available

- October 2024: 5,503 homes available

Looking further back, in September 2019, just before the onset of the pandemic, there were 5,954 homes for sale. After a sharp drop due to increased demand and limited supply during COVID-19, inventory is now approaching these pre-pandemic levels. If this trend continues, we may soon see inventory numbers that provide buyers with even more choices.

Interest Rates: Fluctuations Amid New Fed Policies 📈

The average mortgage interest rate for October 2024 was 6.72%, up from 6.08% in September, and as of November 7, 2024, the rate has risen slightly to 6.79%. While this gradual increase can impact affordability, recent policy decisions by the Federal Reserve may bring future shifts. On November 7, the Fed announced another interest rate cut, signaling an effort to support economic growth amid uncertain conditions.

Despite the rate cut, the future remains unpredictable. According to the latest Forbes analysis, inflation concerns could persist due to potential fiscal policy changes. Buyers hoping for sustained rate declines should monitor these developments closely, as factors like inflation and government policies could lead to rate fluctuations in the coming months.

Although mortgage rates are currently lower than they were in October 2023 (7.22%), the recent Fed decision introduces some optimism for buyers. However, potential inflationary pressures from new policies could mean that rates may not drop as steadily as some might hope. Buyers considering locking in rates may benefit from acting sooner to avoid further increases.

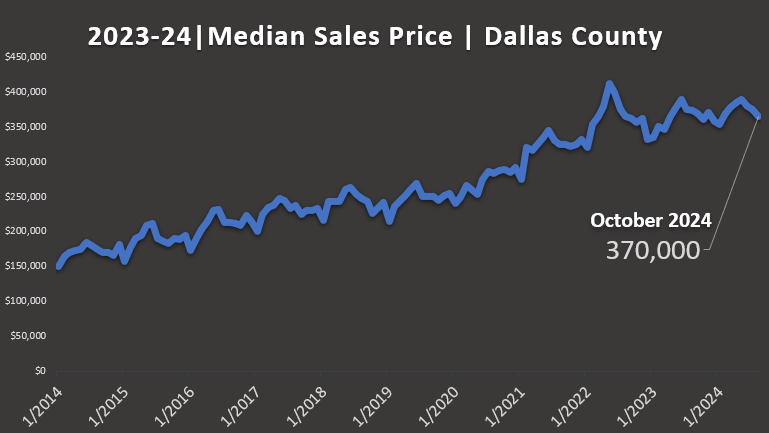

Median Home Price: Stable at $370,000 📉

The median home price in Dallas County remained steady at $370,000 in October 2024, consistent with September’s figure. This price stability, despite rising inventory, suggests that the market is in a holding pattern. However, if inventory continues to grow, downward pressure on prices could become more likely in the coming months.

This stability in median home prices is partially due to seller psychology, as some sellers remain anchored to the high prices seen during the peak of the market in 2022. Additionally, lower interest rates compared to last year may be supporting buyer demand enough to keep prices steady for now. However, should inventory continue to increase and buyer demand wane, prices could begin to adjust downward by early 2025.

Unemployment Rate: Holding Steady at 4.1% 💼

The unemployment rate for October 2024 remained unchanged at 4.1%, matching September’s rate. This stability in the labor market is positive for buyer confidence, as job security often influences purchasing decisions in the housing market.

While the rate is slightly higher than it was a year ago (3.8% in October 2023), it has remained consistent over recent months, which helps support consumer confidence. Any significant increase in unemployment could impact buyer activity, but current trends indicate stability in the labor market.

Summary: A Balanced Market Ahead

As we near the end of 2024, the Dallas County housing market is demonstrating a shift toward balance. Inventory is increasing, providing more options for buyers, while sales activity is cooling in line with seasonal expectations. Interest rates are fluctuating, adding some uncertainty for buyers, but the job market remains stable, which supports consumer confidence.

Looking forward, based on last year’s trends, we expect sales to continue declining into November and December before picking up again in early 2025. Rising inventory could lead to more competitive pricing, especially if demand softens further, creating opportunities for buyers to find favorable deals.

Considering a move? This evolving market could be the perfect time to find your ideal home. Contact us for personalized advice and guidance on navigating the Dallas County real estate market.

Note: Data sourced from CoreLogic, Freddie Mac, and U.S. Bureau of Labor Statistics. These sources reserve the right to modify or update the numbers mentioned in this report at their discretion. Data as of 11/7/2024.