As the real estate market enters the final quarter of 2024, we are witnessing continued changes that reflect both seasonal trends and broader economic shifts. With sales slowing down and inventory increasing, buyers are presented with more choices, while sellers must adjust their expectations. The latest numbers for September reveal that while interest rates are declining, inflation is stabilizing, and unemployment is showing slight improvement, there are still challenges to navigate. Let’s dive into the key data points for the Dallas County housing market in September 2024.

Home Sales: Continued Decline into the Fall 🏠

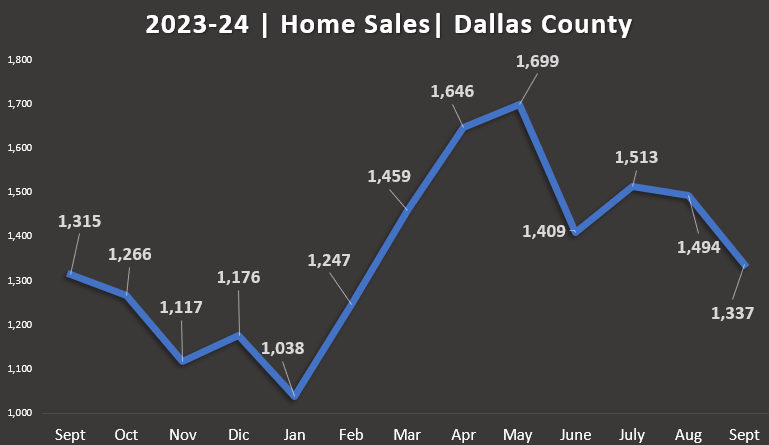

In September 2024, 1,337 homes were sold in Dallas County, reflecting a further decline from August’s 1,494 and continuing the trend of slowing sales as we move into fall. This is typical for the season, as buyer activity generally decreases after the summer peak.

- July 2024: 1,513 homes sold

- August 2024: 1,494 homes sold

- September 2024: 1,337 homes sold

Key Takeaway: As we transition into the colder months, the market is cooling down, with fewer homes sold, as is historically expected in the fall and winter seasons. However, this decrease in demand can also present opportunities for motivated buyers.

Housing Inventory: Approaching Pre-Pandemic Levels 🏘️

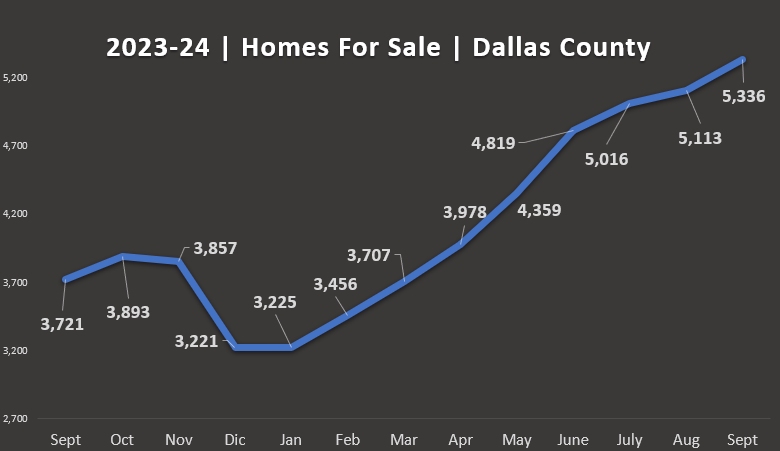

Inventory levels in Dallas County continue to rise, with 5,336 homes available for sale in September 2024, up from 5,113 homes in August 2024. This steady increase throughout the year provides buyers with more options and reduces the competition they face.

Comparing to September 2023, when there were 3,721 homes for sale, we see a 43.4% year-over-year increase in inventory. This significant rise marks a shift in the market toward a more balanced state. However, when we look further back to September 2019, there were 5,954 homes available for sale, showing that we are now approaching pre-pandemic inventory levels.

In December 2019, just before the onset of the COVID-19 pandemic, there were 4,396 homes for sale. Since then, inventory levels have fluctuated dramatically, but we haven’t reached 2019 inventory levels until now. The pandemic created a tight market, driven by factors like historically low interest rates and a surge in demand, which led to a sharp decline in available homes for sale over the last few years.

- September 2019: 5,954 homes available

- December 2019 (pre-pandemic): 4,396 homes available

- September 2023: 3,721 homes available

- September 2024: 5,336 homes available

Key Takeaway: The housing inventory is on the rise and nearing pre-pandemic levels, providing more opportunities for buyers than we’ve seen in recent years. This shift gives buyers more negotiating power as the market cools. However, sellers may need to adjust pricing strategies to compete in this more buyer-friendly environment.

Interest Rates: A Steady Decline to 6.08% 💸

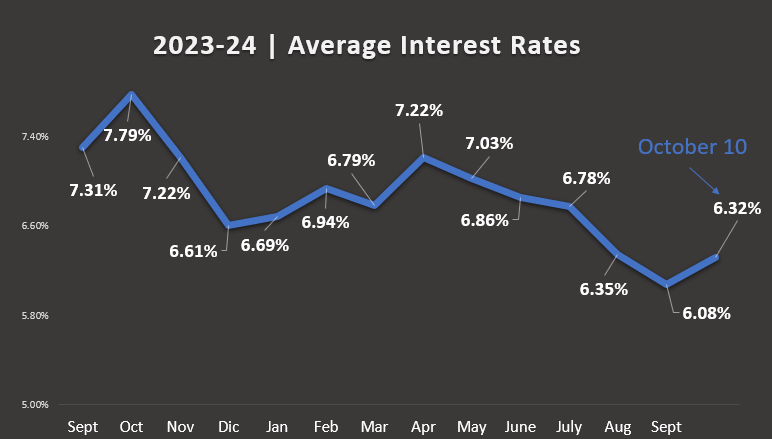

September 2024 saw a significant decline in interest rates, dropping to 6.08%, down from 6.35% in August. Additionally, the current average interest rate stands at 6.32%, as updated today by Freddie Mac.

- July 2024: 6.78%

- August 2024: 6.35%

- September 2024: 6.08%

- October 10, 2024: 6.32%

Key Takeaway: Lower interest rates are a silver lining for buyers, improving affordability and allowing more flexibility in purchasing decisions. However, the recent Fed meeting will be critical in determining the direction of rates for the remainder of the year.

Median Home Price: Stabilizing at $370,000 📉

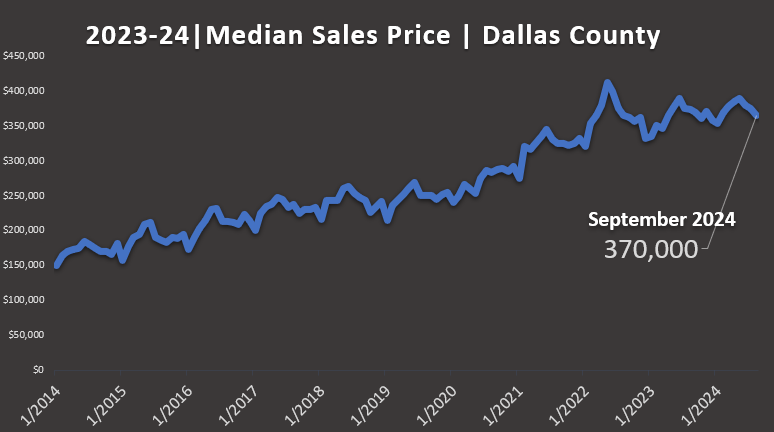

The median home price in Dallas County for September 2024 was $370,000, reflecting a slight increase from August’s $365,000. This stabilization suggests that, despite the rising inventory, prices have not decreased as much as expected.

Normally, a rise in inventory would exert downward pressure on prices as buyers gain more options and sellers face more competition. However, several factors are contributing to the current stabilization:

- Lagging Market Response: The market may need more time to fully respond to the higher inventory levels. Sellers may be slow to lower their prices, holding out for better offers based on earlier market conditions.

- Interest Rate Declines: With interest rates falling to 6.08% in September (and currently 6.32% as of October 10), affordability has improved, which could help maintain demand and keep prices steady, despite the increased number of homes available for sale.

- Seller Psychology: Many sellers may still be anchored to the high prices seen in 2022 when the median price peaked at $412,000 in May. As a result, they might be reluctant to lower their listing prices immediately, opting to wait for buyers willing to meet their expectations.

- September 2019: $250,000 (pre-pandemic)

- May 2022: $412,000 (highest in history)

- August 2024: $365,000

- September 2024: $370,000

Key Takeaway: While rising inventory typically pushes prices downward, factors such as improved affordability from lower interest rates and seller hesitance to reduce prices are helping keep home prices stable for now. However, if inventory continues to increase and demand softens, we may see downward pressure on prices later in the year.

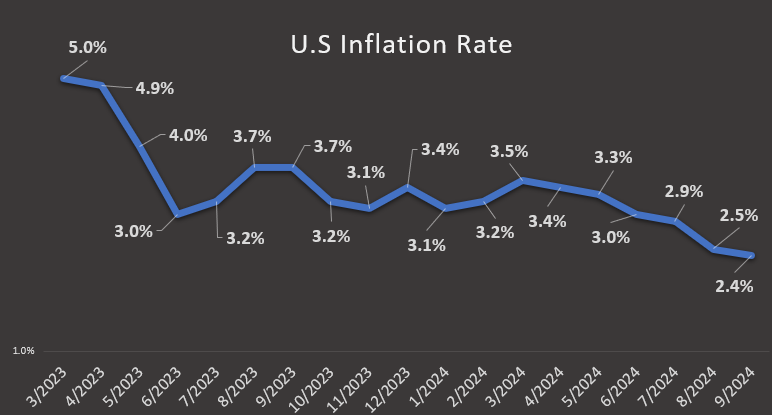

Inflation: A Continued Downward Trend at 2.4% 📉

Inflation in September 2024 decreased to 2.4%, down slightly from August’s 2.5%, continuing the broader trend of falling inflation in 2024. This lower inflation helps stabilize overall costs, including housing-related expenses.

- July 2024: 2.9%

- August 2024: 2.5%

- September 2024: 2.4%

Key Takeaway: The drop in inflation is beneficial for both the broader economy and the housing market, as it stabilizes purchasing power and keeps the cost of living in check.

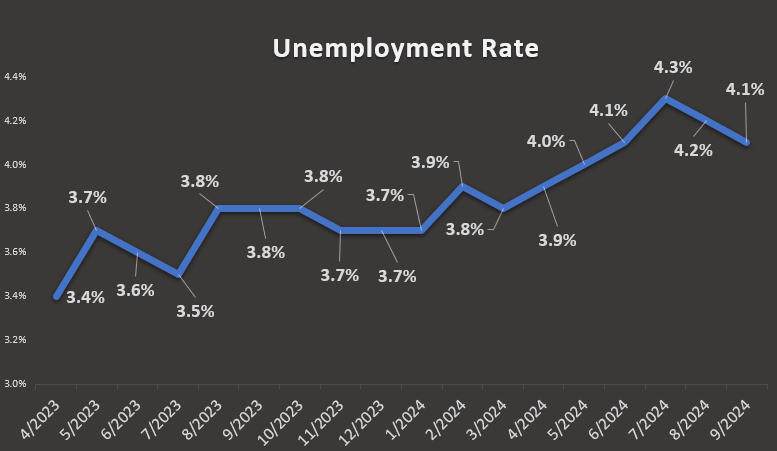

Unemployment Rate: Slight Decrease to 4.1% 💼

The unemployment rate in September 2024 was 4.1%, a small improvement from 4.2% in August. While still elevated compared to earlier in the year, the slight decrease may reflect some recovery in the labor market.

- July 2024: 4.3%

- August 2024: 4.2%

- September 2024: 4.1%

Key Takeaway: The labor market is showing signs of stabilization, but with unemployment still higher than it was earlier in the year, this could continue to influence buyer confidence in the housing market.

Conclusion: What to Expect for the Rest of 2024

As we move into the final months of 2024, the Dallas County housing market continues to show signs of cooling, with fewer home sales but growing inventory, and stabilizing prices. With interest rates declining and inflation under control, buyers have more opportunities, but rising unemployment could dampen demand. Overall, the market is transitioning into a more balanced state, providing buying opportunities for those ready to take advantage of favorable conditions.

💼 Considering a move? Now is the time to explore the growing opportunities in the Dallas County real estate market. Contact us for personalized advice.

Note: Copyright of this data belongs to CoreLogic, Freddie Mac, and the U.S. Bureau of Labor Statistics. They reserve the right to modify or update the numbers mentioned in this report at their discretion. Data was retrieved on 10/10/2024.