As we move further into 2024, the Dallas County housing market continues to evolve, reflecting broader economic trends and seasonal adjustments. With interest rates, unemployment, inflation, and home prices all playing significant roles, understanding how these factors interact is key for buyers, sellers, and investors. Here’s a deep dive into the latest market trends and what they mean for the rest of the year.

Home Sales: A Summer Boost Before a Seasonal Slowdown 🏠

In July 2024, 1,513 homes were sold, reflecting a slight increase from June’s 1,409 homes sold. This uptick in July can be attributed to a mid-summer boost, where buyer activity picked up after a quieter June. However, August saw a slight decline to 1,494 homes sold, signaling the start of the seasonal slowdown that typically occurs during the fall.

Looking Ahead:

- Seasonal Decline Expected: Historically, sales drop after the summer months. For instance, in 2023, sales in September fell to 1,315 homes, and by January 2024, sales reached their lowest at 1,038 homes. A similar trend is expected for the remainder of 2024, with sales likely decreasing to around 1,000-1,200 homes per month by the end of the year due to reduced buyer activity.

- Market Resilience: While the July rebound shows the market is still active, the upcoming months will likely reflect a more typical seasonal cooling in demand, especially with rising unemployment.

Housing Inventory: More Choices, Easing Competition 🏘️

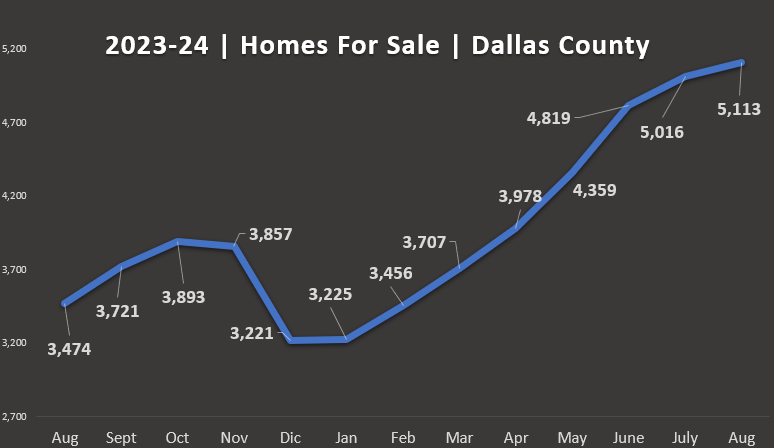

One of the most significant trends in 2024 has been the steady rise in housing inventory:

- May 2024: 4,359 homes

- June 2024: 4,819 homes

- July 2024: 5,016 homes

- August 2024: 5,113 homes

This 17% increase in available homes from May to August gives buyers more options and reduces competition. As inventory continues to grow, buyers are in a better position to negotiate and find properties that suit their budgets and needs.

Looking Ahead:

- Inventory is likely to plateau or slightly decrease in the coming months due to fewer listings during the fall and winter. However, for buyers, this is an excellent time to take advantage of more flexible pricing and a less competitive environment.

Interest Rates: Gradual Decline Supports Buyer Affordability 💸

After peaking in 2023, interest rates have been gradually declining:

- May 2024: 7.03%

- June 2024: 6.86%

- July 2024: 6.78%

- August 2024: 6.35%

The decline in rates has improved buyer affordability, potentially contributing to the uptick in sales seen in July. Lower borrowing costs allow buyers to secure larger loans or reduce their monthly mortgage payments, making it easier to enter the market despite rising inflation.

Looking Ahead:

- The upcoming Federal Reserve meeting on September 17-18, 2024, could lead to another interest rate cut. Analysts predict a possible 25-basis point reduction, which could further stimulate the market in the fall. However, the seasonal slowdown is likely to keep sales from spiking significantly.

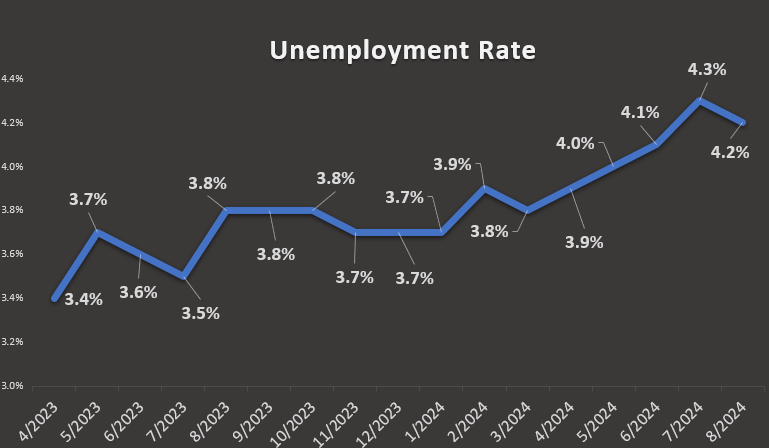

Unemployment: Slight Decline but Still a Concern 💼

The unemployment rate for August 2024 was 4.2%, reflecting a slight improvement from July’s 4.3%. While the decline is encouraging, the overall trend throughout 2024 has been upward, with unemployment rising from 3.9% in April to 4.2% in August.

Rising unemployment can dampen buyer confidence and reduce housing demand, especially for those in more vulnerable job sectors. This, combined with seasonal factors, could contribute to lower home sales in the coming months. Sellers may face longer listing times and more price-conscious buyers, forcing them to reconsider their pricing strategies.

Looking Ahead:

- If unemployment continues to rise, it could lead to more motivated sellers and price reductions, especially in the fall and winter months. This may benefit buyers but challenge sellers to be more competitive.

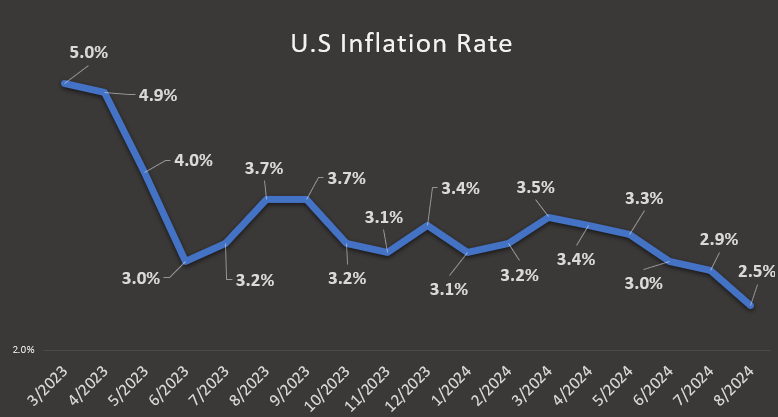

Inflation: Cooling Further to 2.5% 📉

One of the most encouraging trends in 2024 is the continued decline in inflation, which dropped to 2.5% in August 2024. This further cooling of inflation is a strong sign of economic stability, allowing the Federal Reserve more room to manage interest rates.

Looking Ahead:

- With inflation under control, the Federal Reserve has more flexibility to lower interest rates without risking overheating the economy. This creates a more predictable environment for both buyers and sellers, with fewer shocks from rising prices or borrowing costs.

Median Home Price: A Gradual Decline to $365,000 📉

The median home price in Dallas County has been gradually declining:

- May 2024: $390,000

- June 2024: $380,000

- July 2024: $375,000

- August 2024: $365,000

This 6.4% decrease over the past few months indicates that the market is cooling, making it a buyer’s market. The rising inventory and lower demand are putting downward pressure on prices, giving buyers more room to negotiate and find better deals.

Looking Ahead:

- The median home price is likely to continue softening through the end of the year, especially as buyer demand decreases with the rise in unemployment and seasonal factors. Buyers who have been waiting for prices to cool may find favorable opportunities in the coming months.

Conclusion: A Balanced Market Moving Forward 🏡📈

The Dallas County real estate market is transitioning into a more balanced state as we head into the fall of 2024. With increasing inventory, declining prices, and falling interest rates, the market presents significant opportunities for buyers. However, the rising unemployment and seasonal slowdown suggest that sales may continue to decline through the rest of the year.

For sellers, pricing competitively and adjusting to changing market conditions will be key to attracting buyers in this more balanced environment.

💼 Considering a move? Now is the time to take advantage of the market’s evolving opportunities. Contact us for personalized advice on navigating the Dallas County real estate market today! 🏡✨

Note: Copyright of this data belongs to CoreLogic, Freddie Mac, and the U.S. Bureau of Labor Statistics. They reserve the right to modify or update the numbers mentioned in this report at their discretion. Data was retrieved on 9/12/2024.